Ratio Analysis Questions And Answers Pdf

These pages are detachable for ease of. What are the relative business and operating risks to the company.

Financial Statement Analysis Principles Of Accounting Volume 1 Financial Accounting

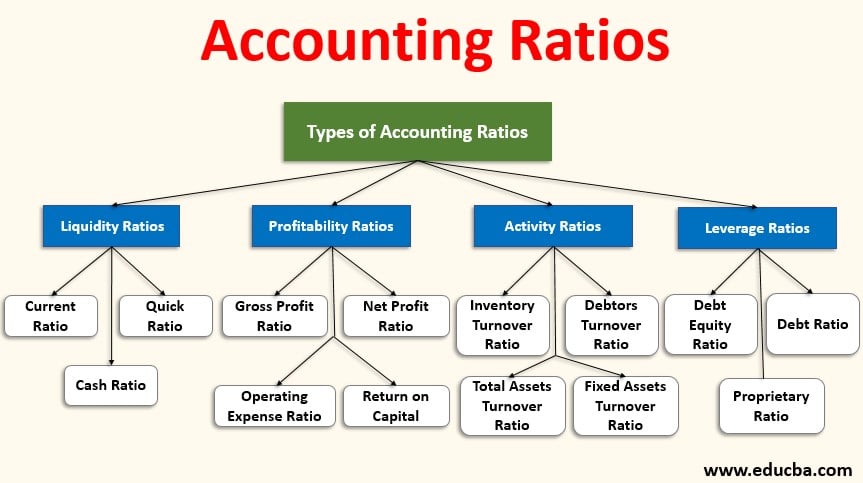

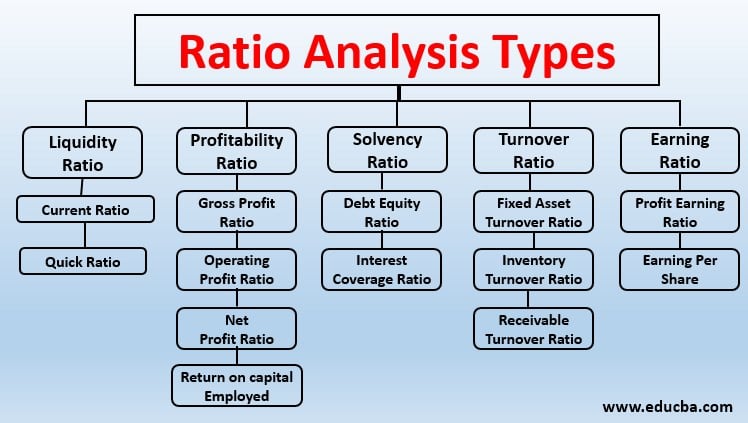

Ratio analysis is the most widely used technique for analysis of financial statements.

Ratio analysis questions and answers pdf. It may be expressed as a. We have also considered the form in which different types of businesses prepare their final accounts. Slow-moving or dead stocks piled up due to poor sales.

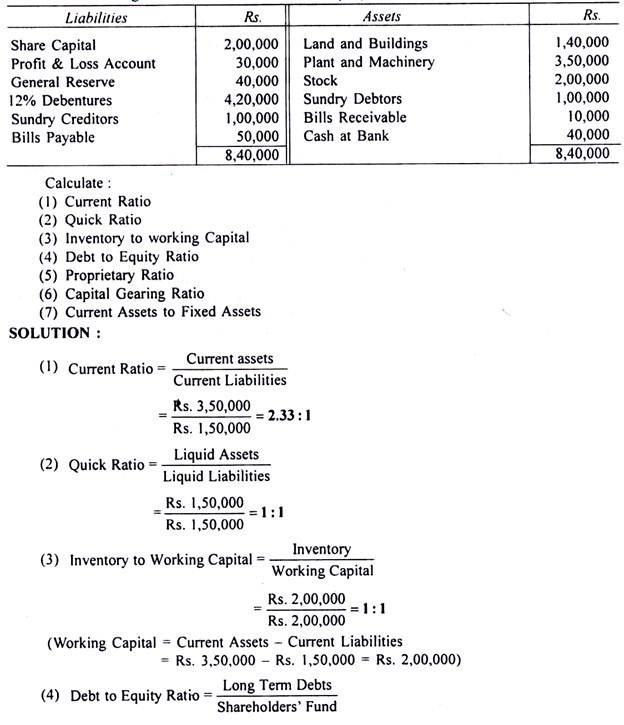

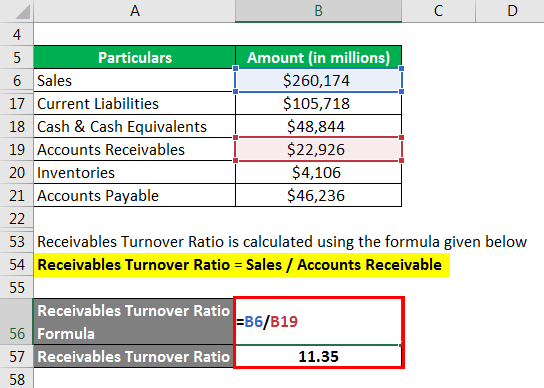

A high current ratio due to the following causes may not be favourable for the following reasons. 1 Determine Debtors turnover ratio if closing debtors is Rs 40000 Cash sales is 25 of credit sales and excess of closing debtors over opening debtors is Rs 20000. Please note that although an analysis of financial ratios will help identify a companys strengths.

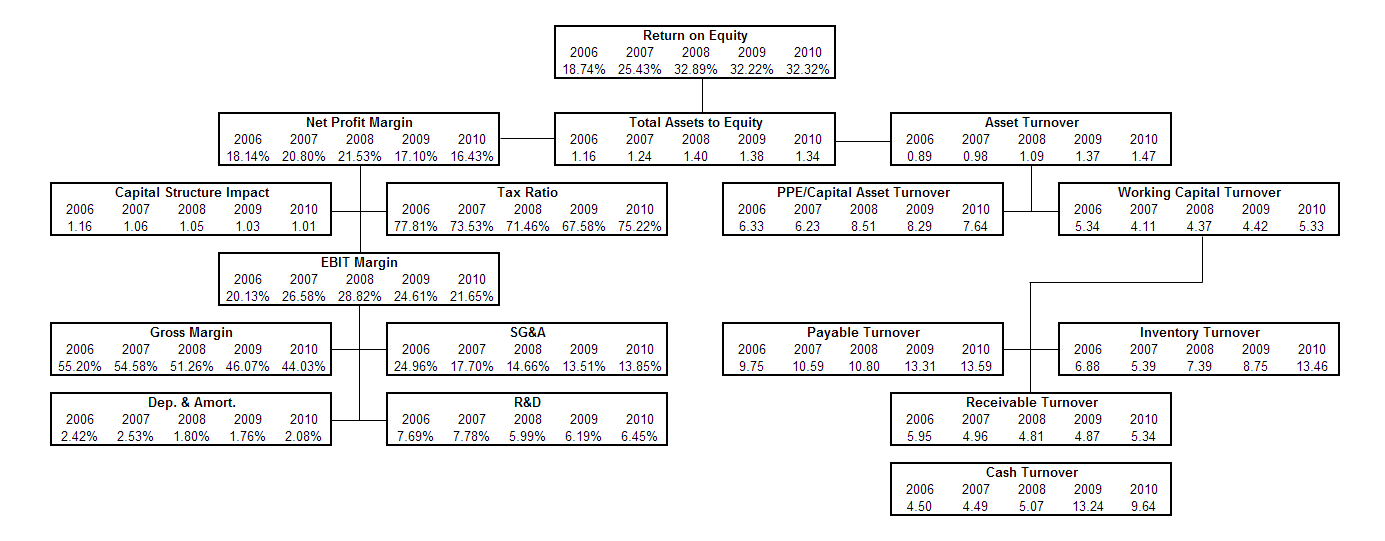

Ratio analysis is an effective tool to assist the analyst in answering some basic questions such as. However we will notfi nd many absolute answers. Ratio Analysis is a technique of financial analysis.

D The quick ratio eliminates inventories from the numerator. B The quick ratio eliminates prepaid expenses for the numerator. A The quick ratio considers only cash and marketable securities as current assets.

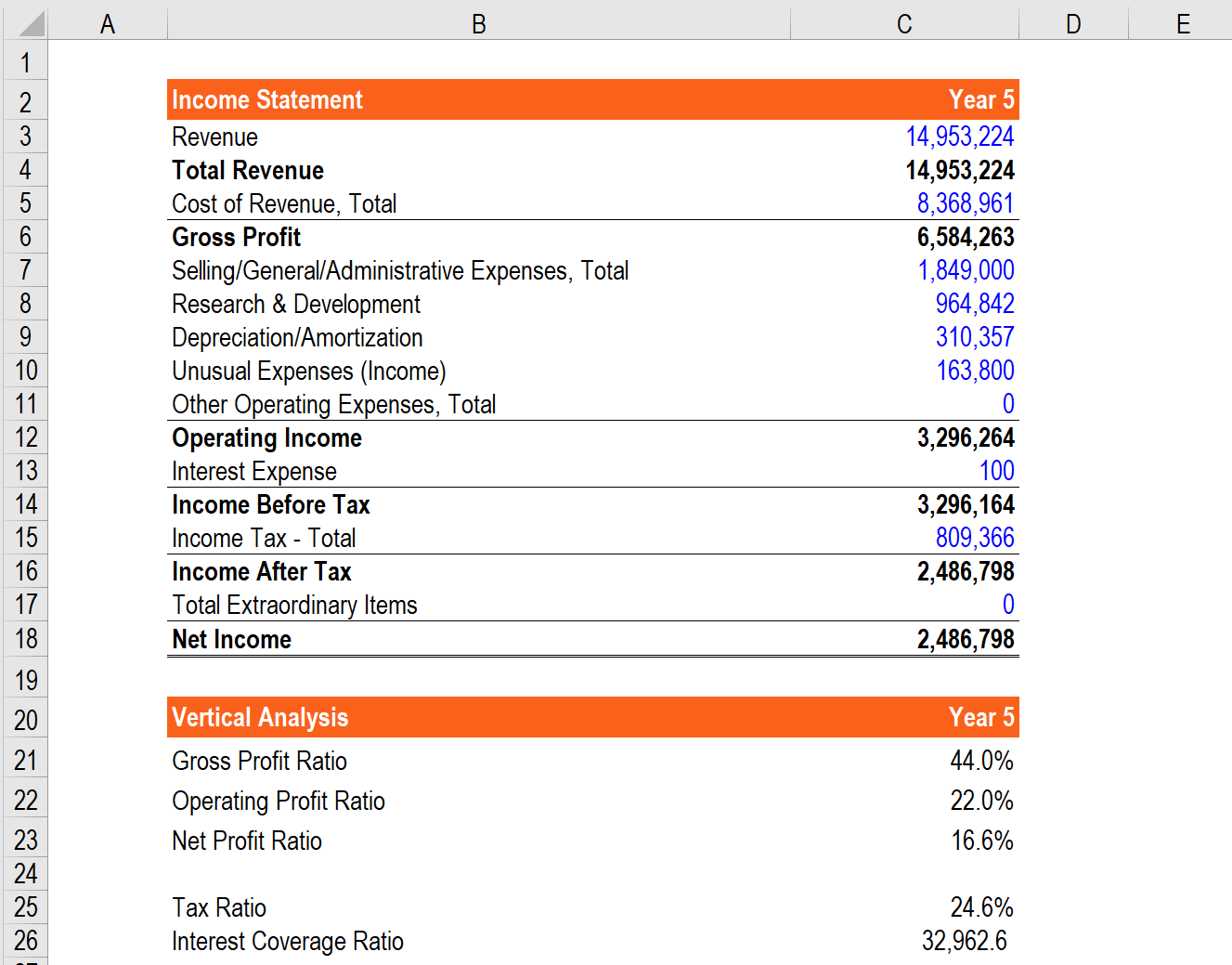

That need to prepare Trading Account to identify values which are not given in the question. Which of the following is considered a profitability measure. Now we need to examine in.

Figure of debtors may be high as debtors are not capable of paying or debt collection system of the firm is not satisfactory. Ideal current ratio is 21. Suggested answer Given below are the calculations for the Current Ratio and the Acid Test 2011 2010 Current Ratio 1041 0971 Acid Test 0711 054 1 Current Ratio The current ratio is obtained by dividing the current assets by the current liabilities.

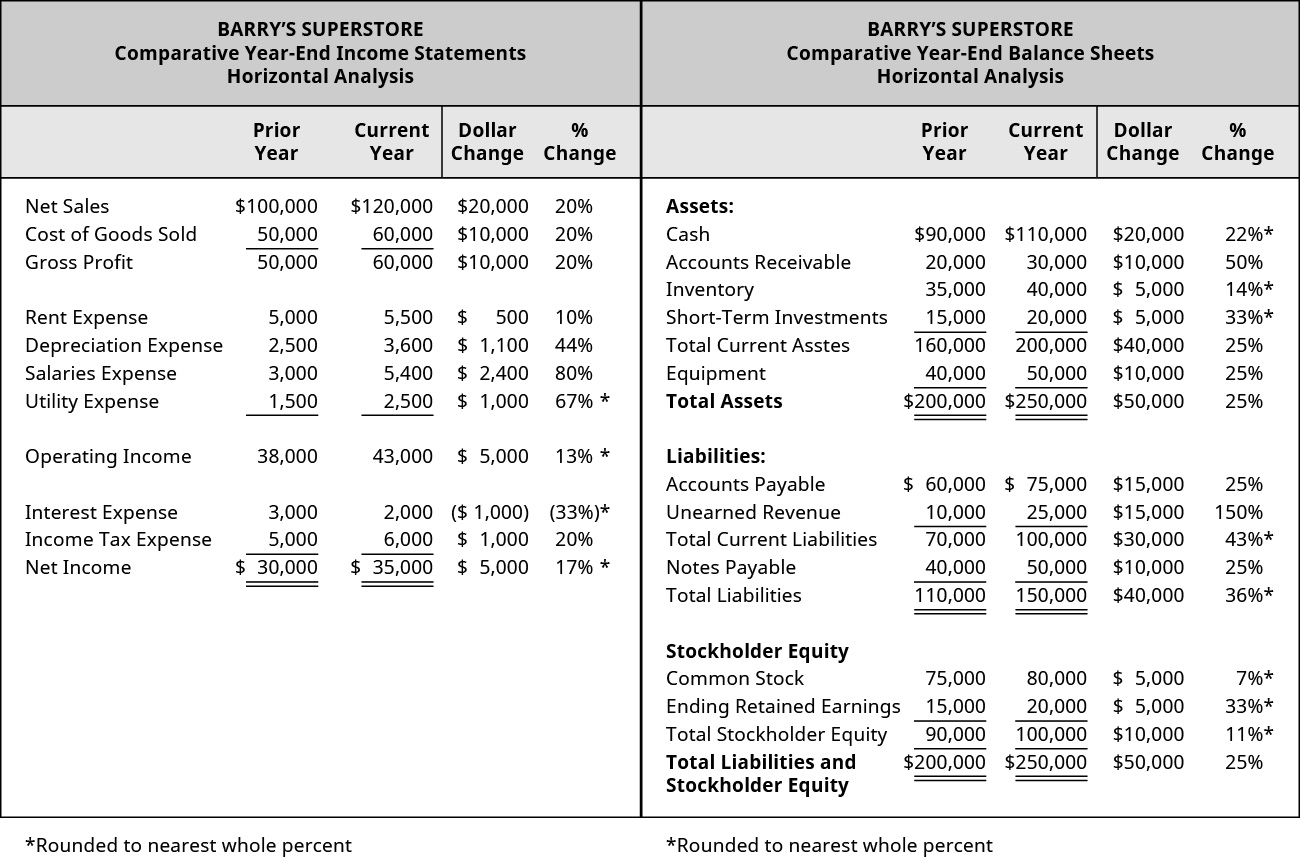

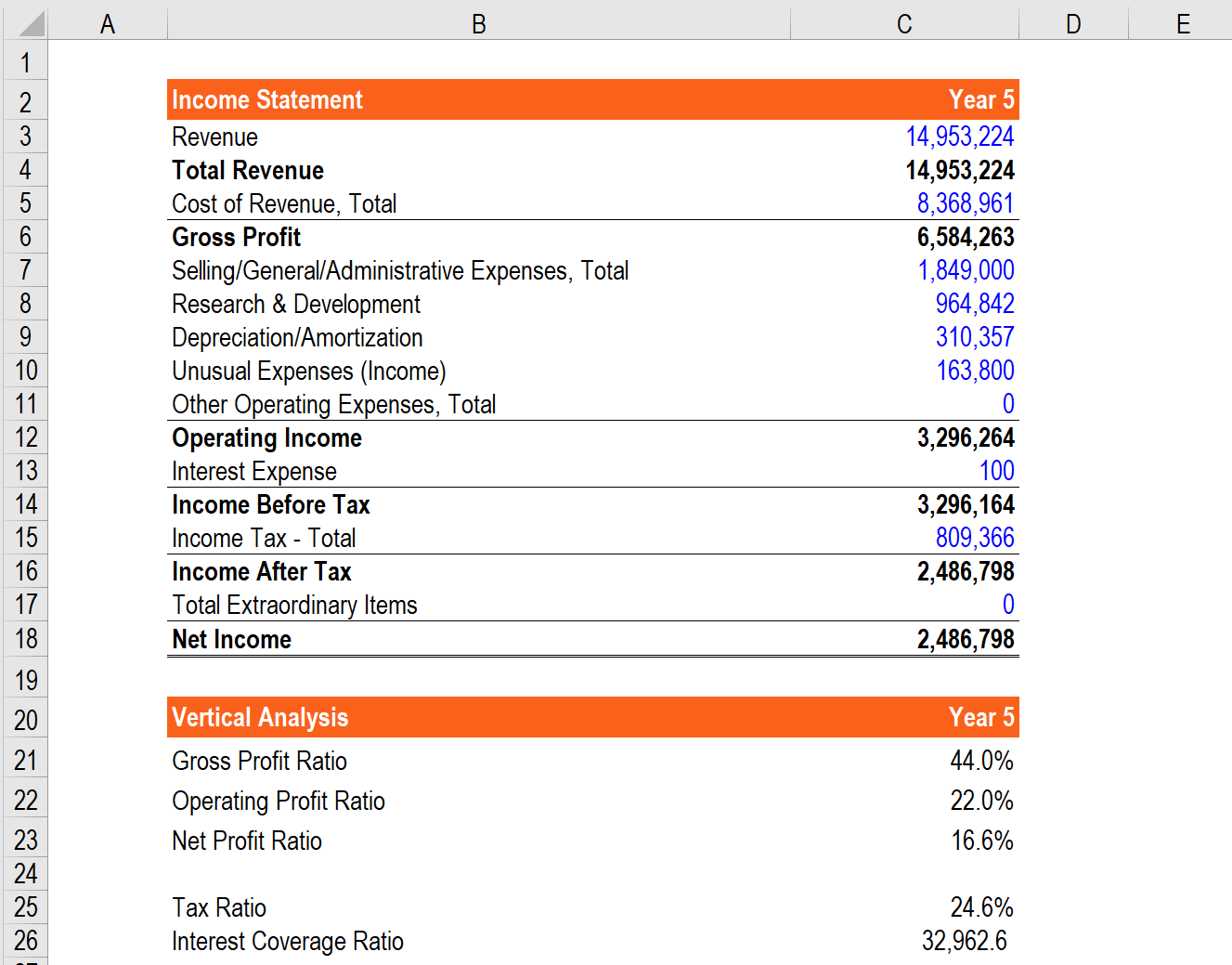

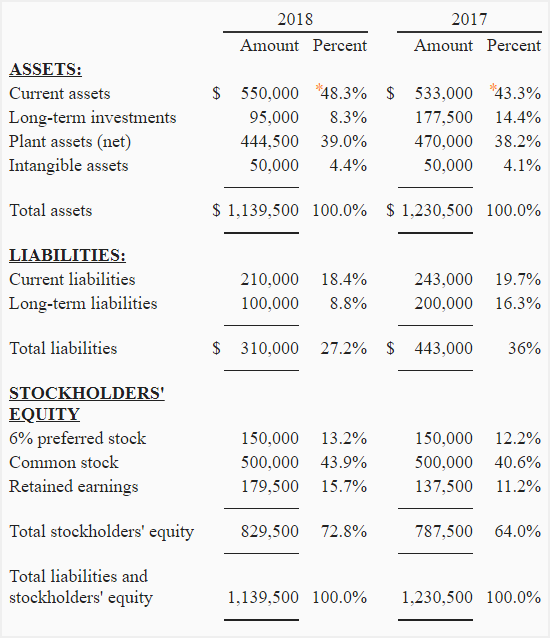

Current ratio b Acid Test Ratio c StockTurnover Ratio d Debtors Turnover Ratio e Creditors Turnover Ratio and Average Debt Collection period. Financial analysis is a powerful tool to help drive investment and management decisions. What is the difference between vertical analysis and horizontal analysis.

Examples of Questions on Ratio Analysis. Ratio Analysis - Finance MCQ Questions and answers. From the following particulars found in the Trading Profit and Loss Account of A Company Ltd work out the operation ratio of the business concern.

Is it making a profit. Comments should be then made about the comparison of the above. No explanation is available for this question.

04062018 Ratio Analysis Business Educationie Ratio Analysis Key Learning Outcomes Introduction Sample Exam. Days sales in inventory. A component percentage is the ratio of a component of an item to the item.

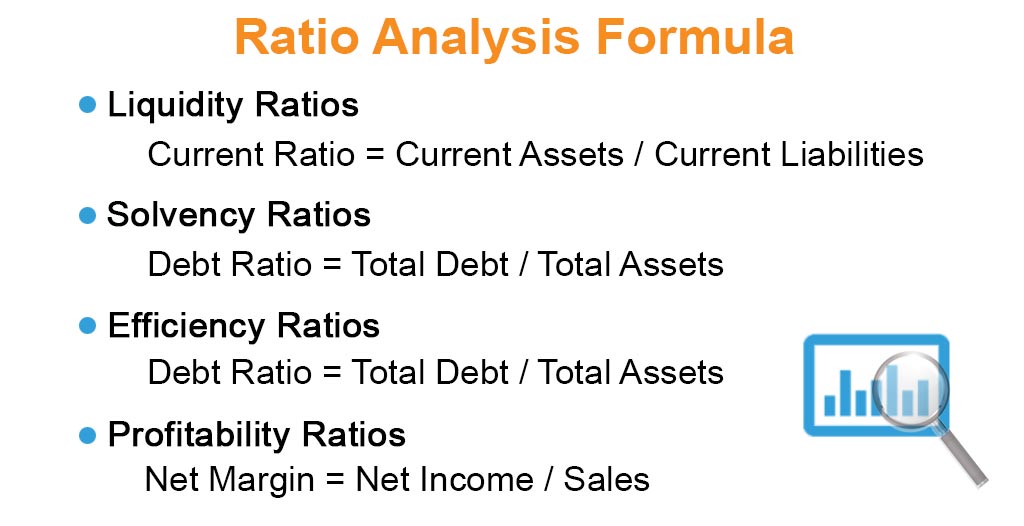

Answer ALL THREE compulsory sub-questions in Section B on pages 6 to 8. Current ratio is calculated by dividing current assets by current liabilities. What is a current asset.

A turnover ratio is a measure of the gross benefit relative to the resources expended. Maths Tables and Formulae are provided on pages 17 to 19. C The quick ratio eliminates prepaid expenses for the denominator.

It provides users with crucial financial information and points out the areas which require investigation. Suggested answer There needs to be the calculation of the under-mentioned ratios in respect of the liquidity. How do you calculate the payback period.

How well is the company doing. Firm A has a Return on Equity ROE equal to 24 while firm B has an ROE of 15 during the same year. The following is the Balance Sheet of a company as on 31st March.

Ratio analysis is a technique of planning and control. 250 Financial Ratio Interview Questions and Answers Question1. What are its strengths and weaknesses.

Current ratio is also known as liquid ratio. What is the gross margin ratio. 2012 2011 Current Ratio 146 128 Acid Test 137 117 The ratios should be described.

Answer TWO of the three questions in Section C on pages 10 to 15. A coverage ratio is a measure of a companys ability to satisfy meet particular obligations. Outsiders will conduct fi nancial analysis differently than managers also referred to as insiders.

This is comprised of eight sub-questions on pages 2 to 5. Ratio analysis is a technique which involves regrouping of data by application of arithmetical. FRatio Analysis 199 3.

Are its assets sufficient to meet its liabilities. What is the difference between gross margin and markup. 52 Objectives of Ratio Analysis Ratio analysis is indispensable part of interpretation of results revealed by the financial statements.

How would the repayment of debt principal be classified. It describes the relationship between various items of Balance Sheet and Income Statements. Ratio Analysis Practical Problems.

It helps us in ascertaining profitability operational efficiency solvency etc. False Working Capital Ratio. Clearly insiders have access.

What we may fi nd is a number of red fl ags that help focus our attention. Here is a compilation of top thirteen accounting problems on ratio analysis with its relevant solutions. Answer the ONE compulsory question in Section A.

Ratios and interpretation As we learnt in our earlier studies accounting information is used to answer two key questions about a business. View Ratio Analysis Practice and Answerpdf from BBS FIN301 at BRAC University. A return ratio is a measure of the net benefit relative to the resources expended.

Accounting Ratios Example Explanation With Excel Template

Ratio Analysis Formula Calculator Example With Excel Template

Ratio Analysis Problems And Solutions Accounting

Financial Ratios Quiz And Test Accountingcoach

Financial Statement Analysis Principles Of Accounting Volume 1 Financial Accounting

The Common Size Analysis Of Financial Statements

The Common Size Analysis Of Financial Statements

Preparing Financial Projections And Monitoring Results Alberta Ca

Comparative Statements Analysis Of Balance Sheet Income Quickbooks

Ratio Analysis Formula Calculator Example With Excel Template

Financial Ratio Analysis Google Search Financial Ratio Financial Engineering Financial Statement Analysis

Financial Ratios Calculations Accountingcoach

Financial Ratios Calculations Accountingcoach

Ratio Analysis Types Type Of Ratio Analysis With Formula

Financial Analysis Overview Guide Types Of Financial Analysis

Vertical Common Size Analysis Of Financial Statements Explanation Example Accounting For Management

Limitations Of Ratio Analysis Ratios Are Popular Learn About The Problems

Financial Ratios Calculations Accountingcoach